All Categories

Featured

Table of Contents

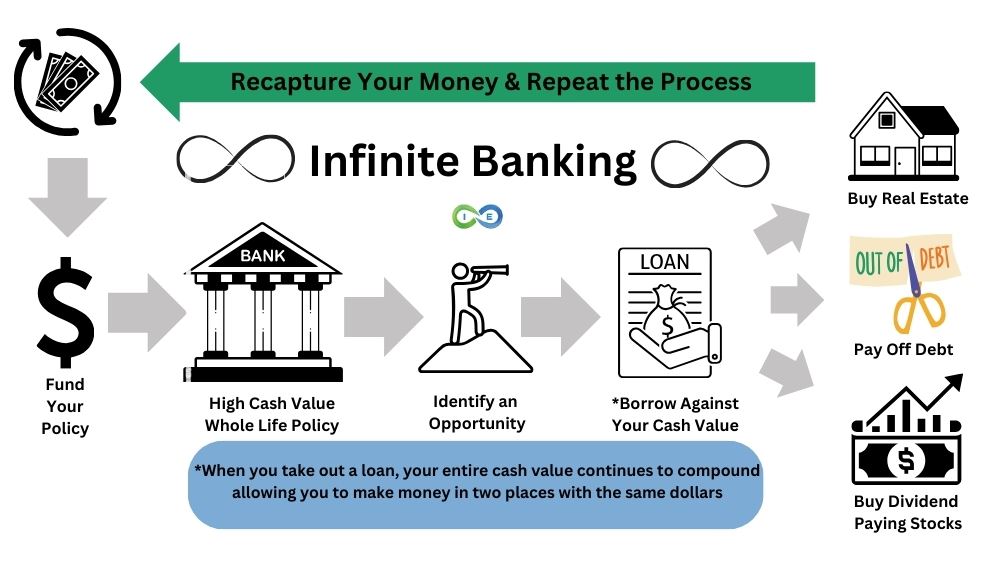

Utilizing the above example, when you obtain that exact same $5,000 loan, you'll make rewards on the whole $100,000. It's still totally funded in the eyes of the shared life insurance policy business. For infinite banking, non-direct recognition policy fundings are optimal. It's vital that your plan is a combined, over-funded, and high-cash value policy.

Cyclists are added features and benefits that can be contributed to your policy for your specific needs. They allow the insurance holder acquisition extra insurance or alter the problems of future acquisitions. One factor you may want to do this is to plan for unanticipated wellness troubles as you get older.

If you include an extra $10,000 or $20,000 upfront, you'll have that cash to the financial institution initially. These are just some steps to take and take into consideration when establishing your way of living financial system. There are several various methods in which you can maximize way of living financial, and we can help you find te best for you.

Infinite Bank Concept

When it comes to financial preparation, entire life insurance policy often stands out as a prominent option. There's been an expanding pattern of marketing it as a device for "unlimited banking (infinite banking software)." If you have actually been discovering entire life insurance policy or have encountered this idea, you may have been told that it can be a way to "become your own financial institution." While the concept might sound enticing, it's vital to dig deeper to comprehend what this actually suggests and why watching whole life insurance policy this way can be misleading.

The concept of "being your own financial institution" is appealing because it recommends a high level of control over your finances. Nevertheless, this control can be illusory. Insurance policy business have the supreme say in exactly how your policy is handled, consisting of the regards to the financings and the prices of return on your cash money value.

If you're thinking about entire life insurance policy, it's necessary to see it in a wider context. Whole life insurance policy can be a useful tool for estate preparation, offering a guaranteed death advantage to your beneficiaries and possibly offering tax advantages. It can likewise be a forced financial savings automobile for those who struggle to save cash constantly.

It's a kind of insurance policy with a financial savings element. While it can use steady, low-risk development of cash money worth, the returns are usually lower than what you might achieve via other investment lorries. Before delving into whole life insurance policy with the concept of limitless financial in mind, take the time to consider your financial goals, threat resistance, and the complete series of economic items offered to you.

Limitless financial is not a monetary remedy. While it can operate in certain circumstances, it's not without risks, and it needs a significant commitment and recognizing to manage properly. By identifying the prospective risks and recognizing truth nature of whole life insurance, you'll be much better outfitted to make an enlightened decision that supports your financial health.

As opposed to paying banks for things we need, like automobiles, residences, and institution, we can purchase methods to keep even more of our money for ourselves. Infinite Financial technique takes an innovative method toward personal financing. The approach basically involves becoming your very own bank by utilizing a dividend-paying whole life insurance policy plan as your financial institution.

How Do I Become My Own Bank

It supplies substantial development over time, transforming the standard life insurance policy policy into a tough monetary device. While life insurance policy business and financial institutions run the risk of with the fluctuation of the market, the negates these threats. Leveraging a cash money value life insurance policy policy, people take pleasure in the benefits of ensured development and a survivor benefit shielded from market volatility.

The Infinite Banking Idea illustrates exactly how much wide range is completely transferred far from your Household or Organization. Nelson additionally takes place to discuss that "you fund everything you buyyou either pay passion to a person else or offer up the interest you could have or else gained". The actual power of The Infinite Banking Concept is that it solves for this trouble and empowers the Canadians who embrace this principle to take the control back over their funding requires, and to have that money streaming back to them versus away.

This is called lost chance expense. When you pay money for points, you permanently quit the chance to make rate of interest by yourself financial savings over several generations. To resolve this issue, Nelson produced his very own financial system via making use of dividend paying getting involved entire life insurance policy policies, ideally through a mutual life business.

As a result, insurance policy holders should meticulously assess their economic goals and timelines prior to deciding for this approach. Sign up for our Infinite Banking Training Course.

Be Your Own Bank With Life Insurance

Just how to get Undisturbed COMPOUNDING on the regular contributions you make to your savings, emergency fund, and retired life accounts How to position your hard-earned cash so that you will never ever have one more sleep deprived evening worried regarding how the markets are going to respond to the next unfiltered Governmental TWEET or global pandemic that your household just can not recover from How to pay yourself initially using the core concepts instructed by Nelson Nash and win at the money game in your own life Just how you can from third event financial institutions and lenders and move it right into your very own system under your control A streamlined way to make sure you pass on your wealth the method you want on a tax-free basis Exactly how you can move your money from forever tired accounts and change them into Never exhausted accounts: Listen to exactly how people just like you can apply this system in their very own lives and the impact of putting it right into action! The period for developing and making significant gains with boundless financial mostly depends on various variables distinct to an individual's financial placement and the policies of the monetary organization providing the solution.

Additionally, a yearly reward repayment is another big benefit of Unlimited financial, additional highlighting its beauty to those tailored towards lasting monetary development. This strategy needs cautious factor to consider of life insurance policy expenses and the analysis of life insurance policy quotes. It's crucial to analyze your credit record and face any kind of existing credit rating card debt to make sure that you remain in a favorable setting to adopt the strategy.

A crucial facet of this method is that there is insensitivity to market variations, because of the nature of the non-direct recognition car loans made use of. Unlike investments connected to the volatility of the markets, the returns in unlimited financial are steady and foreseeable. Nevertheless, extra cash over and above the premium settlements can also be included to speed up development.

Infinite Banking Think Tank

Insurance policy holders make normal premium repayments right into their getting involved whole life insurance policy plan to keep it active and to build the policy's overall cash value. These premium repayments are commonly structured to be consistent and predictable, making sure that the policy remains active and the money worth proceeds to grow over time.

The life insurance policy plan is designed to cover the entire life of a private, and not simply to assist their recipients when the individual passes away. That said, the policy is participating, meaning the policy owner comes to be a component proprietor of the life insurance coverage firm, and takes part in the divisible profit produced in the kind of returns.

"Below comes Earnings Canada". That is not the case. When dividends are chunked back into the plan to acquire compensated additions for no extra cost, there is no taxable event. And each paid up addition also receives returns each and every single year they're stated. Now you may have heard that "returns are not assured".

Latest Posts

Be Your Own Bank: Cash Flow Banking Is Appealing, But ...

Bank Infinity

Why You Should Consider Being Your Own Bank